intelligent ▪ approachable ▪ pragmatic

Helping international finance centres explain their value and unlock their economic potential.

Our work supports governments, agencies, promotional bodies and industry in small international finance centres across the world build resilience, drive growth and shape global policy.

We’ve worked with international finance centres, such as the British Virgin Islands, Jersey, the Isle of Man and Mauritius, to deliver impactful research, strategy and economic modelling.

Our recent projects have helped clients to:

We collaborate with local stakeholders and international experts to deliver clear, actionable insights – all grounded in evidence, and tailored to each jurisdiction’s unique context.

intelligent ▪ approachable ▪ pragmatic

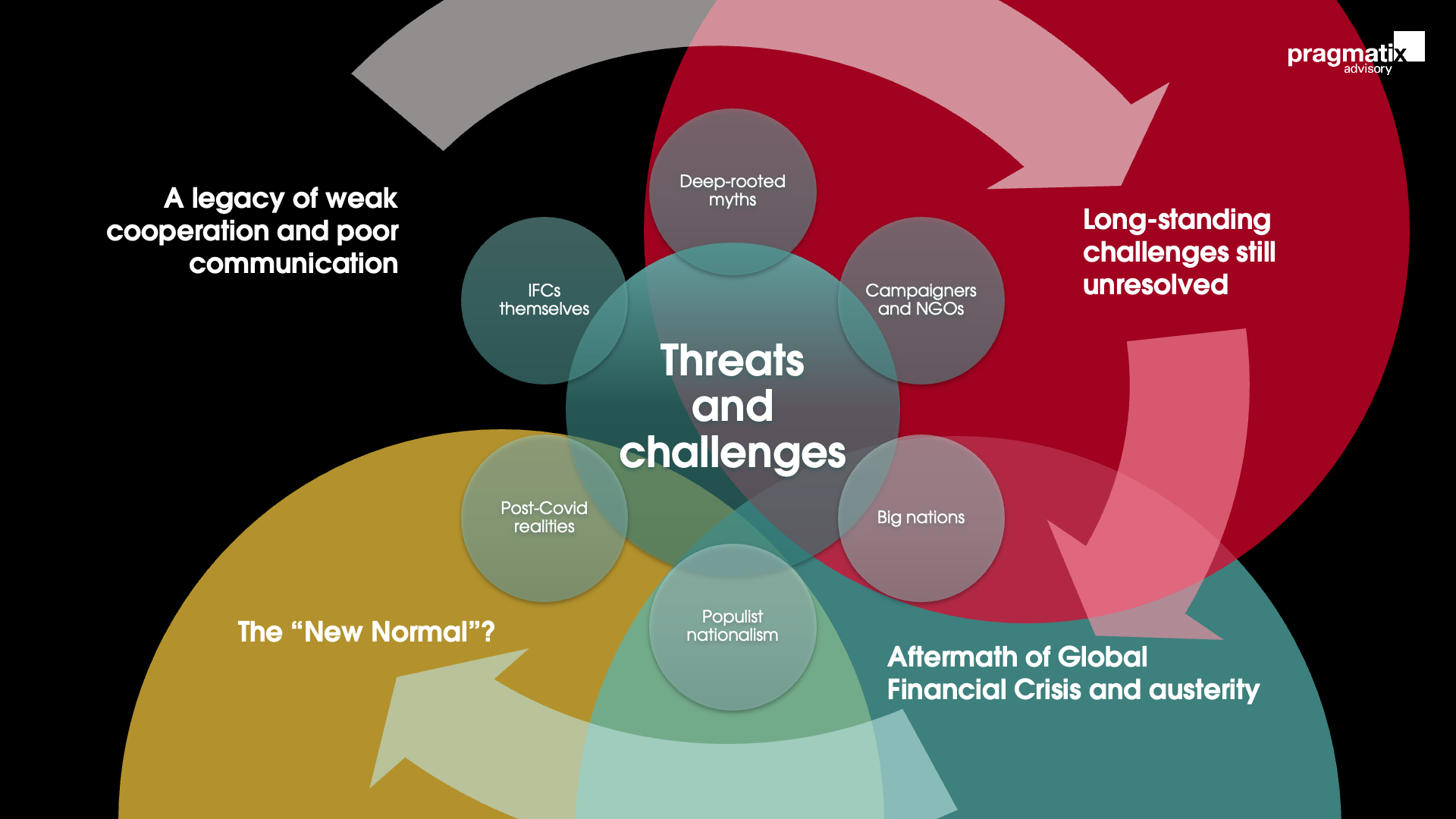

We understand the challenges

Growing threats to IFCs and the cross-border finance industry

-

The golden beaches and palm trees tax haven myth

Home to billionaires and no ‘real’ people

Unsustainable, imbalanced and parasitic economies

Territories and dependencies reliant on the largess of their ‘parent’ nation

-

Money laundering, tax evasion and secrecy

Weak regulation and supervision

“Unfair” tax regimes

Abuse of developing countries

Only for benefit of rich and privileged

-

Supposed tax losses

Threat to tax losses

Tax competition

Clash of sovereignty

-

Squeezed middle of globalisation

‘Unfair’ international competition

Danger of open borders

-

Closed or restricted borders

Reinforcement of populist nationalism

Search for scapegoats

China-United States tensions, including future of Hong Kong

Pressure on supply chains

-

Sibling rivalry: competition above collaboration

Keep heads down: keen to avoid the first mover disadvantage

Limited resources and clout

Parochial agenda

Weak domestic political / popular support

Confused sovereignty and alliances

intelligent ▪ approachable ▪ pragmatic

We help IFCs address the challenges

intelligent ▪ approachable ▪ pragmatic